|

No 36 1st Quarter 2008 |

A N D S T U D I E S I N W O R L D E C O N O M Y

The CEPII - Past CEPII Newsletters - PDF Format - Subscribe / Unsubscribe

C O N T E N T S:

FOCUS

1978-2008: an Anniversary for 30 Years of Research

ON THE RESEARCH AGENDA

A FDI Database for Global Trade Models

The Impact of Economic Geography on Wages: Disentangling Channels of Influence

The Location of Japanese MNCs Affiliates: Agglomeration, Spillovers and Firm Heterogeneity

The Impact of Agricultural Policies on Developing Economies

High Oil Prices Increase Regionalism

DATABASES

CHELEM-GDP: New Basis for PPP Calculation

EVENTS - WORKING PAPERS - RECENT PUBLICATIONS - FORTHCOMING

In 1978, when the CEPII was created by former Prime Minister Raymond Barre, it was far from evident for many people that Europe would face the shaking wave of globalisation that has been experienced since then. To be sure, Europe had already suffered a world economic shock - the first oil shock - and was about to face a second one. Capital flows were still highly regulated as well as services and China and the Soviet union were still out of the world economy. From the very beginning, the CEPII put together and harmonised data on the world economy to produce consistent analyses on ongoing deep changes in trade flows, sector specialisation, the international monetary system and new industrialised countries that were later to be renamed 'emerging countries'. Here we overview 30 years of CEPII's researches in two areas: international trade, and exchange rates, based on successive issues of La Lettre du CEPII.

International Trade

Measuring countries specialisation has been a major concern from the very beginning of CEPII’s research life. A first indicator is proposed in 1979, which measures specialisation independently of trade balances. In the late 1970’s and early 1980’s, the focus then is on the dynamic aspect of specialisation (countries can build their comparative advantages) and on the distinction between its "intensity" and "quality", the latter depending on adaptation to world demand (1983). In1987, an innovative typology is proposed that makes a distinction between one-way trade (a product is either exported or imported), vertical two-way trade (a product is both exported and imported but at different levels of quality) and cross-trade of similar products (horizontal two-way trade). This typology, subsequently refined in the 1990’s, is widely used today. It led CEPII to build, alongside the Chelem database used since 1978, a new harmonised bilateral flow database, BACI, detailing bilateral trade volumes and values for some 5,000 products. To throw light on the trade negotiations launched by the WTO, in 2001 the CEPII built a general equilibrium model – MIRAGE – for simulating trade policies while accounting for the interaction of markets for goods, services and production factors, in quantities and prices, covering all national economies participating in negotiations. As negotiations are taking place at very detailed level of tariff lines, the model had to be linked to a detailed, exhaustive, bilateral database on obstacles to trade. To this end, the MAcMaps database was developed jointly by CEPII and the International Trade Centre. This model has been extensively used by the CEPII and partner institutes for studying the Doha agenda, but also regional integration and bilateral initiatives.

Exchanges Rates

In September 1980, the dollar lies at a low level (the equivalent of 1.63 euro!). It can be read in a Lettre du CEPII that "the exchange rate has once again become an economic weapon" and that the dollar is under-valued against many currencies (with the notable exception of the yen) in terms of purchasing power parity, but also in terms of a standard incorporating levels of development (Balassa-Samuelson effect). In 1994, several years after Plaza and Louvre agreements, the CEPII notes the inability of international monetary system to prevent "long-term distortions of real exchange rates", the instability of nominal exchange rates and, already, the accumulation of current account imbalances. It lists three challenges that the international monetary system would have to meet: the spread of capital market liberalisation, the development of regional monetary co-operation agreements and the rise of emerging economies. It suggests that international co-ordination should no longer be based directly on exchange rates but, upstream, on the principles of economic policy. It calls for the reactivation of IMF multilateral monitoring of exchange rate policies, particularly those of emerging economies. International monetary co-ordination assumes agreement on "normal" or "equilibrium" exchange rate values. The CEPII’s research in this field since the mid-1990’s highlights, respectively, the uncertainty surrounding calculations of equilibrium exchange rates, the extent of exchange rate adjustments necessary to correct world-wide imbalances, the need to consider regional interaction in assessing exchange rate distortions and, finally, the need for a multilateral approach to exchange rate distortions. The period 1999-2007 started with a strong depreciation of the Euro against the dollar, followed by a spectacular rise. This volatility of the Euro came as no surprise to CEPII, which anticipated it in 1997. In 2000, the CEPII mentions the risk of “an upward overshooting, which it would perhaps be difficult to combat due to the potentially diverging interests of the players in European economic policy". As a matter of fact, the very strong rise of the euro since 2001 and, even more so, since 2006, has not created sufficient consensus in Europe to establish an exchange rate policy.

Bibliography

Global Overview of Trade Policies David Laborde May 2007 La Lettre du CEPII N° 267

WTO Trade Talks: a Bird in the Hand is Worth Two in the Bush Lionel Fontagné David Laborde Cristina Mitaritonna January 2007 La Lettre du CEPII N° 263

Argentina's Debt and the Decline of the IMF Jérôme Sgard January 2005 N° 241

Speculating on the Yuan Bronka Rzepkowski May 2004 N° 234

The World Market: Market Shares and Export Performances Angela Cheptea Guillaume Gaulier Soledad Zignago February 2004 N° 231

The WTO: in the Trough of the Trade Round Lionel Fontagné Sébastien Jean September 2003 N° 226

Sovereign Debt Crises and Multilateral Action Following the Rejection of the Krueger Proposal Jérôme Sgard May N° 223

Argentina One Year On: From a Monetary Crisis to a Financial Crisis Jérôme Sgard December 2002 N° 218

Euro/dollar : Every Body can Make Mistakes Agnès Bénassy-Quéré September 2002 N° 215

International Trade, Borders and Market Institutions Jérôme Sgard July-August 2002 N° 214

Market Access: the Objectives after Doha Lionel Fontagné Jean-Louis Guérin Sébastien Jean April 2002 N° 211

Can the Argentine Peso Resist Competition from the Dollar? Jérôme Sgard February 2002 N° 209

Rethinking the South's Openness Isabelle Bensidoun Agnès Chevallier Guillaume Gaulier October 2001 N° 205

Trade Integration and Monetary Integration Jean-Louis Guérin Amina Lahrèche-Révil September 2001 N° 204

How is Trade Protectionism to be Measured? Antoine Bouët Estelle Dhont-Peltrault November 2000 N° 195

The IMF and the Challenge of Global Governance Michel Aglietta Sandra Moatti October 2000 N° 194

Exchange Rate Regimes: With or Without the Sucre? Agnès Bénassy-Quéré June 2000 N° 191

The Ecuadorian Crisis and the International Financial Architecture Jérôme Sgard March 2000 N° 188

Openness, Competition and Multilateralism Michel Fouquin Guillaume Gaulier November 1999 N° 184

What Should the Framework for Opening up to the International Economy be? Jean-Louis Guérin July-August N° 181

The Devaluation of the Yuan: "A Little Impatience May Ruin a Great " (Confucious) Stéphane Dées Françoise Lemoine April N° 178

This situation comes mainly from the lack of suitable databases for such studies. The widely used GTAP dataset does not include any FDI information. The aim of this work is to fill this gap by creating a FDI database suitable for applied general equilibrium (AGE) works. The problems, which have previously precluded such a construction, are twofold:

- First, The scarcity of FDI data. International institutions only provide those related to their own mission, leading to incomplete datasets. To build a complete bilateral and sectoral FDI database, we need to rely on numerous sources like Eurostat, IMF, OECD, UNCTAD and the WIIW. But many values are still missing. Consequently, to complete the database, we fill the missing values with econometric estimates from a gravity regression.

- Second, the different sources are largely inconsistent from one another. As this database is designed for AGE works, it needs to be balanced. We proceed to the matrix-balancing by minimizing a quadratic loss function between prior and final values while respecting the balancing constraints.

The Impact of Economic Geography on Wages: Disentangling Channels of Influence

In New Economic Geography (NEG) models, the spatial distribution of demand is a key determinant of economic outcomes. Theoretical developments and growing empirical evidence on the NEG (Head and Mayer, 2004; Redding and Venables, 2003 and 2004; and Hanson, 2005) explain the emergence of a heterogeneous economic space on the bases of increasing returns to scale and transport costs (Krugman, 1991 and 1995). While a number of studies have by now shown the relevance of access to markets in the determination of per capita income levels, we understand much less clearly the precise mechanisms through which it operates.

This work employs a fully specified empirical model to evaluate the channels through which market access might affect wages evolution. To this end, it presents two innovations. Our first contribution is to build market access indicators at the provincial level from data on domestic and international trade flows. Moreover, our analysis will control for province specificity constant over time so as to focus on the impact between market access and wage of provinces over time. The second innovation is to rely on a system of equations describing the incidence of market access on several determinants of wage. Moving away from single-equation estimates, our results based on a simultaneous equations system capture different theoretical arguments on the potential different channels through which economic geography impacts upon wage increases. Variables proxying the various channels (export performance, physical and human capital accumulation) proposed by the literature are included in a wage regression. By multiplying the effects of market access on the channel and the effect of the channel on wage, the indirect contribution of access to markets through that specific channel can be identified. Estimations on 29 Chinese provinces for 1995-2002 suggest that access to sources of demand is indeed an important factor in shaping regional wage dynamics in China. A fair share of its benefits seem to come from increased incentives for exporting and accumulating physical capital. On the opposite, the accumulation of human capital does not seem to play a significant role. Direct transport cost advantages remain the main source of influence.

Our study builds on previous literature on the determinants of location choices of foreign affiliates by Japanese firms (Belderbos and Carree, 2002; Head et al., 1995; Fukao et al. 2003; Kimura and Kiyota, 2006). Our analysis based on the new economic geography theory assesses the importance of various determinants of FDI profitability. It focuses on the effect of market and supplier access, as well as production and trade costs and explores whether the effects of key determinants of locational choice vary substantially depending on the characteristics of the investing firm and the plant.

Our motivation is two-fold. First, we expect our results to shed light on the controversial productivity-internationalization nexus. It has become something of a stylized fact that ex-ante productivity determines the choice of whether or not to invest abroad (Greenaway and Kneller, 2007). However new evidence stresses that the productivity distribution between multinationals and non multinationals is not so clear cut. Further investigation of the determinants of location choices is thus required.

Our second motivation relates to the identification of potential barriers to internationalization of Japanese firms. We investigate whether Japanese parents of different productivity and size respond differently to host countries' features such as distance, institutional quality or access to markets and to networks and spillovers. Much evidence suggests that related firms tend to cluster in the same regions. We consider three forms of relatedness. The first two relate to the host location (1) affiliates in the same industry originating from the same country (Japan) and (2) downstream affiliates originating from the same country. The third form (3) captures proximity at home (in the same Japanese prefecture) to parents having affiliates in the same destination country. Clusters of related firms may form regional production networks, selling intermediate inputs to each other, sharing knowledge and thereby lowering production costs. We also investigate whether location choices are influenced by the presence of JETRO.

The economic assessment of agricultural policies is usually undertaken in the GTAP framework that implies to work at a rather aggregate level, while trade policies are determined at the level of individual products. Trade policy aggregation and the conversion of trade barriers into their ad valorem equivalents can lead to some biases. It is all the more true in agriculture as border protection mainly takes the form of specific tariffs and tariff-rate quotas. We propose to overcome the possible biases by explicitly modelling agricultural trade flows and trade policies at the 6-digit level for European and American agricultural imports (648 HS6 positions).

The main conclusion that comes out of this work is the concentration of the gains from trade liberalisation in a limited number of products. Eight HS6 positions concentrate half of the trade increase. The [4–6] per cent of sensitive products of the Falconer proposal in the WTO negotiation covers [75–83] per cent of potential trade increase of developing countries exports to European and American markets. It means that the bulk of the liberalisation will occur in this list of sensitive products, whose specific treatment and consideration appear as crucial.

Christophe Gouel & Priscila Ramos

Oil prices have been multiplied by 5 recently, raising from about 20 to more than $US100 per barrel in less than a decade. Because of the rapid development of some large economies like China and India, oil prices are expected to grow further in the following decades. It is well known that oil shocks create many direct and indirect macroeconomic effects, on inflation, employment, GDP, real wages and productivity.

The objective of our research is to highlight another macroeconomic implication of oil shocks through trade, while using micro-type data. More precisely, we want to study the impact on the geographical distribution of trade costs and thereby trade flows. If one believes that an increase in oil prices makes products from distant partners more expensive than those of close ones, then one would expect oil prices to favor regionalism, while acting in parallel as a resistance force against long distance trade. As a consequence, oil price increases might then affect welfare in much the same way as regional trade agreements (RTAs) would do. An oil price shock would divert trade flows from more efficient (or low cost) partners to less efficient partners, resulting in a welfare loss for the importing country. For close exporters however, oil price shocks would then be welfare creating.

More rigorously, how can oil prices affect trade costs and thereby trade flows? Trade theory suggests that as long as transport costs are proportionally linked to oil prices, a global shock such as an increase in oil prices decreases imports from the rest of the world but without affecting bilateral market shares. That is because a global oil shock should increase all prices proportionally, thus leaving all relative prices unaffected.

If, however, transport costs do not respond proportionally to oil prices, market shares can be seriously altered. In our theory, we assume such a framework and then take it to the test. To fix ideas, we assume a general transport cost function whereby the cost of shipping a good implies variable but also fixed costs. This simple although realistic assumption makes the impact of oil shocks to depend on the extent to which transportation is governed by variable costs relative to fixed ones. It turns out that more distant economies suffer more from an increase in oil prices than closer trading partners. That is because oil prices affect variable costs, which share in total costs increases with longer distance. In a second step, we embody this new technology function of transport into a gravity equation of trade consistent with the latest literature on gravity (Anderson and Van Wincoop, 2003 and Baier and Bergstrand, 2007).

Based on Robert Feenstra’s US imports and fret charges dataset over 1974 to 2000, we find first that oil prices affect positively relative transport costs of distant partners and negatively those of closer ones to the US. Further, this results in an induced elasticity of relative market shares to oil prices of around 0.03 for Canada and Mexico, economies close to the US and around -0.03 for countries highly distant from the US. Keeping all other things equal, this means that an increase in oil prices by a factor of 5 in later years would have contributed to a 15% increase in US relative imports from its ALENA’s partners, at the expense of more distant trading partners.

Daniel Mirza & Habib Zitouna

PPP rates are computed in the framework of the International Comparison Program (ICP) conducted by the ICP Global Office within the World Bank. The price for a basket of specific products and services for each country is calculated. The PPP rate is the rate making it possible to trade this basket for the reference basket, usually the US one. Then, purchasing power of different currencies can be compared. The latest estimates of ICP are the most comprehensive since the launching of the project in 1968. This recent regional survey has collected 2005 prices in 146 countries for about 1000 commodities. About one hundred developing countries are participating in the ICP project. For most of them, former data were very old: Indian data for instance dated back to 1985. China is now in the project. Of course, comprehensive data for the two major emerging economies have a big impact on the estimate of world GDP. And since the 2005 PPP rates for these two countries are much lower than assumed so far, that leads to significantly reduce their share in world GDP. Consequently, projections for world growth are revised downward (CEPII, 2008a ; Elekdag & Lall, 2008).

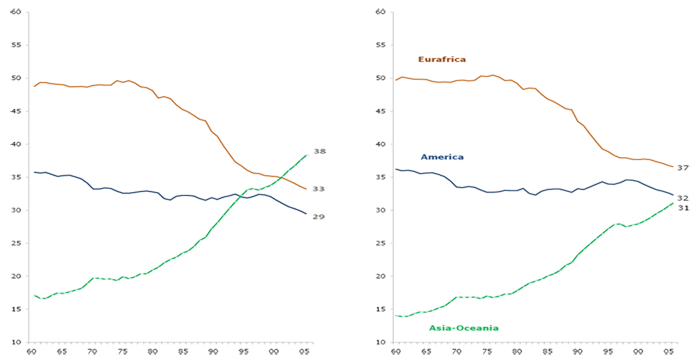

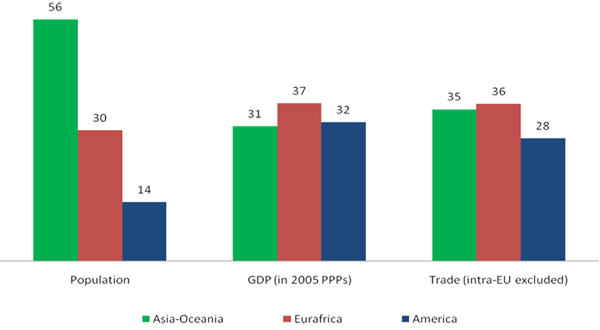

The 2008 version of CHELEM GDP-Database uses 2005 as the reference year for PPP GDPs (CEPII, 2008b). It uses the PCI data for 146 countries part of the project and estimates PPPs for more than fifty additional countries, in order to cover all countries or regions in the world. PPP GDP levels are extrapolated for the 1960-2006 period by applying to 2005 levels the GDP volume indices (2000 prices). Graph 1 compares the shares of the three major regions of the world in the global GDP, estimated with 2000 and 2005 PPP rates alternatively. By using the same volume indexes in both cases, the curves have, of course, similar slopes. The Asia-Oceania region recorded the largest growth over the past four decades. However, its level of catch-up vis-à-vis Eurafrica and America differs significantly depending on the year of reference for the PPPs. With the 2000 rates, there was a shift in the geographical breakdown of global GDP: since the start of the millennium the share of Asian countries exceeded those of the two other regions (38% in 2006). The new estimates indicate that with 31% of world GDP in 2006 the Asia-Oceania has not yet caught up with the level of production in America (32%) and is still below that of Eurafrica (37%). Nevertheless the Asian countries are and will remain for a long time the most dynamic in the world economy. Indeed, while their share in world production and trade is now close to that of the other two major regions, their population counts for 56% of the world population (Graph 2).

Graph 1

Share in the World GDP in Purchasing Power Parities

(in %)

Estimated with 2000 PPPs Estimated with 2005 PPPs<

Source : CHELEM-GDP Database.

Graph 2

Share in the World Population, GDP and Trade in 2006

(in %)

source: CHELEM-GDP-CIN Databases.

References

CEPII (2008a), Figure of the month, February

CEPII (2008b), CHELEM-GDP Database

Elekdag, S. & Lall, S. (2008), "Global Growth Estimates Trimmed After PPP Revisions", IMF Survey magazine, January 8

World Bank (2008), 2005 International Comparison Program-Tables of Final Results, February 26

Colette Herzog & Deniz Ünal-Kesenci

Europe and the World - CEPII's 30th anniversary

February 12, 2008

From the creation of the European coal and steel community, in 1951, to the single European act in 1986 and the European monetary unification in 1999, European integration has proved mostly inward-looking. Still, a number of external, economic policies have been transferred to the EU level. These mainly concern trade policies and, for the Euro area, exchange-rate policies. Through competition policies, the European union has also gained a say to foreign multinationals (see, e.g., the Microsoft case). In other areas, such as public aid to developing countries or climate change, competencies are shared between Member states and the EU level, but the Kyoto protocol stands as one major success of EU countries in speaking with one voice.

In 1978, when the CEPII was created by former Prime Minister Raymond Barre, it was far from evident for many people that Europe would face the shaking wave of globalisation that has been experienced since then. To be sure, Europe had already suffered a world economic shock - the first oil shock - and was about to face a second one. Capital movement were still highly regulated as well as services and China and the Soviet union were still out of the world economy. From the very beginning, the CEPII assembled and harmonised data on the world economy to produce consistent analysis on ongoing deep transformations of trade flows, sector specialisation, the international monetary system and new industrialised countries that were later to be renamed 'emerging countries'.

Consistently with this background, the CEPII celebrated its 30th anniversary through a conference on "Europe and the world", held in Paris on February 12th 2008. Five sessions covered the main external economic policy issues the European has to deal with: trade, exchange rates, development policies, climate change, firm globalisation. Former directors and presidents of the CEPII, together with old companions and supporters of the research centre, were invited to speak on these various topics. Michel Camdessus (former Managing Director of the IMF) opened the conference by asking whether Europe could act as a substitute for the lacking international financial governance observed since the beginning of the 2007 crisis. His opening speech was complemented with that of State Secretary for Prospective and Public Policy Assessment, Eric Besson, who praised independent expertise as an indispensable material for policy decisions. Subsequent sessions gathered together François David (Coface), Pascal Lamy (WTO), Lionel Fontagné (University Paris 1), Anton Brender (Dexia AM), Jean-Pierre Landau (Banque of France), Patrick Artus (Natixis), Yves Berthelot (CFSI), Pierre Jacquet (French Development Agency), François Bourguignon (Paris School of Economics), Francis Ailhaud (Groupama AM), Roger Guesnerie (Collège de France), Francis Mer (Safran), Michel Albert (French Academy of Moral and Political Sciences), Louis Gallois (EADS), Jacques Lesourne (Futuribles), André Sapir (Bruegel) and Philippe Marini (French Senate). Then, a roundtable on the economic position of Europe in the world was animated by Jean-Michel Charpin (French Ministry of Finance), with Jean-Claude Berthelémy (University Paris 1), Jean Lemierre (EBRD), Jean Pisani-Ferry (Bruegel), Christian Sautter (Paris Town Hall), Christian Stoffaës (President of CEPII's Board) and Hubert Védrine (Hubert Védrine Conseil).

It would be difficult to summarise in a few lines the ideas developed during these days. The lack of a common European view on external issues was pointed out by a number of speakers, although the weight of the EU as a global player was also recognised. The conference ended with a short speech by Jean-Pierre Jouyet, State Secretary to European Affairs, in charge of the French Presidency of the EU. Jean-Pierre Jouyet listed the priorities of the French Presidency starting in July 1st 2008. He more specifically mentioned three challenges that the EU would need to face : demography (including migrations), competitiveness (including R&D) and energy (plus climate change). He expressed his willingness to see the EU become a global, unafraid actor.

The Euro and the Intensive and Extensive Margins of Trade: Evidence from French Firm Level Data

N°2008-06, April 2008

We improve the study of the effects of a Currency Union on trade. Using data on French exports at the firm level, we compute an intensive and extensive margins of French exports - with a variety dimension - over the period 1998-2003. Estimation results indicate that nominal exchange rate volatility has a negative effect, which translates into the intensive and extensive margins. We also provide some evidence that the euro had an additional positive effect on the extensive margin; this effect is not related to the reduced nominal exchange rate volatility. This suggests a new varieties effect of the euro.

On the Influence of Oil Prices on Economic Activity and Other Macroeconomic and Financial Variables

N°2008-05, April 2008

The aim of this paper is to investigate the links between oil prices and various macroeconomic and financial variables for a large set of countries, including both oilimporting and exporting countries. Both short-run and long-run interactions are analyzed through the implementation of causality tests, evaluation of cross-correlations between the cyclical components of the series in order to identify lead/lag relationships and cointegration analysis. Our results highlight the existence of various relationships between oil prices and macroeconomic variables and, especially, an important link between oil and share prices on the short run. Turning to the long run, numerous long-term relationships are detected, the causality generally running from oil prices to the other variables. An important conclusion is relating to the key role played by the oil market on stock markets.

François Lescaroux & Valérie Mignon

An Impact Study of the EU-ACP Economic Partnership Agreements (EPAs) in the Six ACP Regions

N°2008-04, April 2008

This study intends to present a very detailed and dynamic analysis of the trade-related aspects of Economic Partnership Agreements (EPAs) negotiations. We use a dynamic partial equilibrium model - focusing on the demand side - at the HS6 level (covering 5,113 HS6 products). Two alternative lists of sensitive products are constructed, one giving priority to the agricultural sectors, the other focusing on tariff revenue preservation. In order to be WTO compatible, EPAs must translate into 90 percent of bilateral trade fully liberalised. We use this criterion to simulate EPAs for each negotiating regional block. ACP exports to the EU are forecast to be 10 percent higher with the EPAs than under the GSP/EBA option. On average ACP countries are forecast to lose 70 percent of tariff revenues on EU imports in the long run. Yet imports from other regions of the world will continue to provide tariff revenues. Thus when tariff revenue losses are computed on total ACP imports, losses are limited to 26 percent on average in the long run and even 19 percent when the product lists are optimised. The final impact on the economy depends on the importance of tariffs in government revenue and on potential compensatory effects. However this long term and less visible effect will mainly depend on the capacity of each ACP country to reorganise its fiscal base.

Lionel Fontagné, David Laborde & Cristina Mitaritonna

The Brave New World of Cross-Regionalism

N°2008-03, April 2008

Cross-regionalism is a new fashion in preferential trading whereby countries, large or small, participate simultaneously in various Free Trade Areas. They seem mostly to be a reflection of the increasing rivalry of the United States and the European Union for drawing the attention by emerging middle-sized and small economies. This trend is profited then by the latter to diversify their previous (almost) exclusive economic relations with a given "hub". A strategy consisting in multiplying the number of Free Trade Areas is perfectly suited both to "hubs" and "spokes". According to the old North-South pattern, economic powers concluding preferential deals sought mainly to reap the political benefit of extending their sphere of influence and small countries the economic benefit of market access to a large market. Now new pattern is emerging whereby the two partners are motivated both by economic and political reasons. One clear result is that spheres of influence are on the wane. But this is of no help to least developed countries.

Alfred Tovias

Equilibrium Exchange Rates: a Guidebook for the Euro-Dollar Rate

N°2008-02, March 2008

In this paper, we investigate different views of equilibrium exchange rates within a single, stock-flow adjustment framework. We then compare FEER and BEER estimations of equilibrium exchange rates based on the same, econometric model of the net foreign asset position, with special focus on the euro-dollar rate. These estimations suggest that, although more robust to alternative assumptions, the BEER approach may rely on excessive confidence on past behaviors in terms of portfolio allocation. Symmetrically, FEERs may underestimate the plasticity of international capital markets because they focus on the adjustment of the trade balance.

Agnès Bénassy-Quéré, Sophie Béreau & Valérie Mignon

How Robust are Estimated Equilibrium Exchange Rates? A Panel BEER Approach

N°2008-01, March 2008

This paper is concerned with the robustness of equilibrium exchange rate estimations based on the BEER approach for a set of both industrial and emerging countries. The robustness is studied in four directions, successively. First, we investigate the impact of using alternative proxies for relative productivity. Second, we analyze the impact of estimating the equilibrium equation on one single panel covering G20 countries, or separately for G7 and non-G7 countries. Third, we measure the influence of the choice of the numeraire on the derivation of bilateral equilibrium rates. Finally, we study the temporal robustness of the estimations by dropping one or two years from the estimation period. Our main conclusion is that BEER estimations are quite robust to these successive tests, although at one point of time misalignments can differ by several percentage points depending on the methodology. The choice of the productivity proxy is the most sensible one, followed by the country sample. In contrast, the choice of the numeraire and the time sample have a relatively limited impact on estimated misalignments.

Agnès Bénassy-Quéré, Sophie Béreau & Valérie Mignon

Testing the Finance-Growth Link: is There a Difference Between Developed and Developing Countries?

N°2007-24, December 2007

We revisit the evidence of the existence of a long-run link between financial intermediation and economic growth, by testing of cointegration between the growth rate of real GDP, control variables and three series reflecting financial intermediation. We consider a model with a factor structure that allows us to determine whether the finance-growth link is due to cross countries dependence and/or whether it characterises countries with strong heterogeneities. We employ techniques recently proposed in the panel data literature, such as PANIC analysis and cointegration in common factor models. Our results show differences between the developed and developing countries. We run a comparative regression analysis on the 1980-2006 period and find that financial intermediation is a positive determinant of growth in developed countries, while it acts negatively on the economic growth of developing countries.

Gilles Dufrénot, Valérie Mignon & Anne Péguin-Feissolle

Labor Migration: Macroeconomic and Demographic Outlook for Europe and Neighborhood Regions

N°2007-23, December 2007

In this paper, we assess the demographic and economic consequences of migrations in Europe and neighborhood countries. In order to do so, we rely on a multi-region world overlapping generations model (INGENUE2). The rich modeling framework of this multi-regions model allows us to put into connection migration with the "triangular" relationship between population aging, pension reforms and international capital markets. With this model, we are also able to quantify the demographic and economic consequences of migration flows on both the regions receiving and losing migrants. Our analysis is based on a very detailed migration scenario between Western Europe and the Neighborhood regions constructed by taking into account both the current situation and some prospective empirical scenarios. Our quantitative results shed some light on the long term consequences of migration on regions that are not at the same stage in the ageing process. Concerning the regions receiving migrants, despite some improvement of their public pension system, it appears that a realistic migration scenario does not offset the effect of ageing in these regions, leaving room for pension reforms. Concerning the regions losing migrants, the adverse economic consequences of emigration appear to be all the more important than the region is advanced in the ageing process (and is already suffering from a declining population).

Vladimir Borgy & Xavier Chojnicki

ECONOMIE INTERNATIONALE, QUARTERLY

-

Politiques de libéralisation financière et crises bancaires Full text

Saoussen Ben Gamra & Dominique Plihon

La demande de titres longs par les non-résidents explique-t-elle le bas niveau des taux longs publics américains ?

Bruno Ducoudré

Outward Foreign Direct Investment and Intermediate Goods Exports: Evidence from the USA

Kemal Türkcan

Explaining Inflation Differentials in the Euro Area: Evidence from a Dynamic Panel Data Model

Julien Licheron

Crédit individuel et informalité sont-ils compatibles ? Une expérience brésilienne

Laure Jaunaux

Economie Internationale publishes papers dealing with a wide range of issues in applied international economics. Papers cover topics like macroeconomics, money and finance, trade, transition, European integration and regional studies. Economie internationale especially encourages the submission of articles which are empirical in nature and emphasises the rigor of empirical analyses and data processing. With articles being submitted from economists in various universities, central banks and private financial institutions worldwide, the journal achieves an extraordinary diversity and provides many viewpoints on international economic and financial questions. Articles should be readable by non-specialists. Economie Internationale is indexed in Econlit. |

|

N° 272 November 2007

After a long absence, China and India are returning to the world economic stage. Their penetration of international commerce/The breakthrough they have made in international trade has for the past decade borne witness to their/ strong presence in industries linked to the digital revolution. Their ascension is having knock-on/far-reaching effects on global supply and demand for goods and services. They are the kingpins/hubs of a new international division of labour and are making increasingly significant contributions to global growth, even though they cannot yet boost/pull the growth of the rest of the world by themselves.

Françoise Lemoine & Deniz Ünal-Kesenci

The Very Select Club of Exporting FirmsN° 271 October 2007

Globalization is everywhere. At least, that’s the impression that it gives: more and more countries are opening up to international trade and fewer and fewer sectors seem to be protected from international competition. This impression correctly matches traditional analyses, which consider that international trade is a matter of specialisation between sectors and mainly focus on barriers such as customs duties and transport costs. But access to fine grain data, at the level of each exporting firm, reveals a quite different landscape and enables us to paint a more accurate and more finely shaded picture of globalization. Analysis of the Custom and Excise and INSEE databases shows that the proportion of French firms that have a direct export activity is astonishingly low and that these businesses are clearly distinguished from the others: they are larger, more productive and pay their employees higher wages. In order to understand the real extent of the internationalisation of markets and better identify the barriers that really stand in the way of the export capacities of a country like France, we need to turn the spotlight on these "stars", which are the driving forces of globalization.

Matthieu Crozet & Thierry Mayer

China is Shipping more Products to the United States than GermanyN° 270 September 2007

Recent theoretical and empirical literature on international trade has renewed our understanding of specialisation and competition, especially between developed and emerging economies. Specialisation operates at the level of varieties instead of product or sector-level. Furthermore, competition selects the most productive firms and the best performing of their products. Using this dual approach, we investigated the market for manufactured imports in the United States. The emerging countries are winning large market shares there, particularly for the most technological products. It is especially in this field that some of them are managing to combine an increase in market share with a higher value of the products exported. How can older industrialised countries face up to this competition? The comparison between two export champions, China and Germany, illustrates how market positioning and the selection effect operate in the US market.

Lionel Fontagné & Rodrigo Paillacar

Monetary Policy and Exchange Rates: the Euro and the Dollar

Conference organized by OECD with the support of CEPII

May 13, 2008

OECD Forum 2008

Conference organized by OECD with the support of CEPII

June 3-4, 2008

| Publisher: AGNES BENASSY-QUERE, Director of the CEPII Chief Editor: DOMINIQUE PIANELLI Web Assistant: Isabelle Bartolozzi ©CEPII-2004 |

Subscription manager: SYLVIE HURION Address: CEPII - 9, rue Georges Pitard - 75015 Paris - France Tel. (33) 1 53 68 55 00 - Fax: (33) 1 53 68 55 03 https://www.cepii.fr |